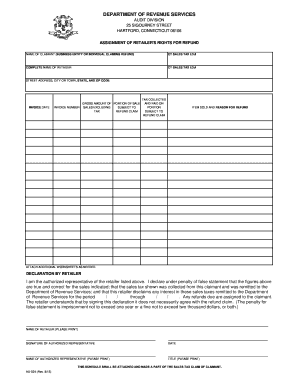

CT DRS AU-524 2017-2024 free printable template

Get, Create, Make and Sign

Editing connecticut refund claimant latest online

CT DRS AU-524 Form Versions

How to fill out connecticut refund claimant latest

How to fill out Connecticut refund claimant latest:

Who needs Connecticut refund claimant latest:

Video instructions and help with filling out and completing connecticut refund claimant latest

Instructions and Help about connecticut au 524 form

This is a review of the apace audio steno a 524 mp3 player and memory stick this is what comes in the package it includes headphone set with a lanyard a USB extender cable it's just an extender and an additional headphone set with lanyard, so this is the device give a look at this here's the device has a microphone on the end to headphone jacks loop for a lanyard nothing much on the back this is a 1 gigabyte unit on the top we have a whole button and a reset button and a slot for a micros card you can take a 1 gigabyte card you pull this tip off standard USB plug power up the unit with sons the hold buttons on powder by pushing the play button in the middle you get the butterfly animation see if I can get this close you can see I'm going to zoom in there we go now you can see the format is mp3 192 kills a bit no-repeat the equalizer is set to normal I've full battery I'm 10 seconds in on the track with four minutes 26 total play time this is the 14th track up 58 on this unit and the volume set pretty high I'm going to plug it in, so you can hear okay I'm going to turn the volume down, so it's not too loud keep it in focus get a little more you can see it's got a waveform display while the units playing and click up go through the menus you can set the repeat type go through that real quick let's go back to this menu there's an equalizer you can change the equalization settings you can even set your own the real problem with this thing is up and down is navigated by clicking left or right that always fools me 3d sound effect is like the wide setting playwright you can set it to play a little faster a little slower you're listening to boys intro no idea tried several settings never works display you can choose what kind of animation you have there's now a little stereo you be neater than, and then we'll go out to the different features this is a recording menu if you record using this microphone it generates a file called Mike dessert or zero taught wave the recordings are kind of low quality 22 kilohertz, but you can put quite a bit of time on this unit FM radio well have it seek to another channel you can make presets and things like that you can also record FM by holding down this button it begins to create a file this one's going to be called FM 0002 that wave it'll be on the device and put it into computer that this is the setup menu you can choose how long stays powered up the language how bright display is some tools I'll let you delete files format the device reset up get info I have 673 megabytes free let's go back to the music menu another trick that it do I really like I hope you have to be playing it to get to its menu it's the file browser you can see all the files on your device even the data files, so this is all the music I have put that and then this is my data folder it skips right past it, but it seeks to any level finds every mp3 file on this no matter how we make the directors it finds every file and that's it let me give you...

Fill au 524 fill : Try Risk Free

People Also Ask about connecticut refund claimant latest

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your connecticut refund claimant latest online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.